When we speak about currency valuations – the amount you pay at the airport change office when you arrive in a new country on holiday in need of some local cash – we typically aren’t thinking about central bank interest rate policy. Instead, top of mind is probably something as simple as, “how much will I need to get through breakfast?” or perhaps, “how do I divide everything by 14?” Nevertheless, interest rate policy is at the heart of all that is Forex.

Interest rates are set by the central bank based upon the vitality of a country’s economy. When economic activity is weak or during a recession, rates are lowered to encourage borrowing and stimulate growth. If however, the economy is steaming along, unemployment is low and prices are going up, the central bank will increase rates in order to reduce the risk of rampant inflation and overheated conditions.

Central bank interest rate policy is also an international competition for capital. A higher rate in one country – or in the case of the Euro, a group of countries — will attract international investment from other countries with lower prevailing rates. Higher rates will increase the value of one currency when compared to others with lower rates. And in reverse, lowering rates will reduce the value of the local currency as it is traded in world markets.

A great example of a divergence in policy occurred between the U.S. and the European Central Bank (ECB) in 2014. It offered wonderful trade opportunities week after week. Starting in 2008, during the great recession, the U.S. Federal Reserve loosened monetary policy and even began buying bonds in the open market to stabilize the economy. This policy had a positive impact. When conditions stabilized, the Fed reversed course and (very gradually) began to tighten, first by reducing new purchases of debt instruments.

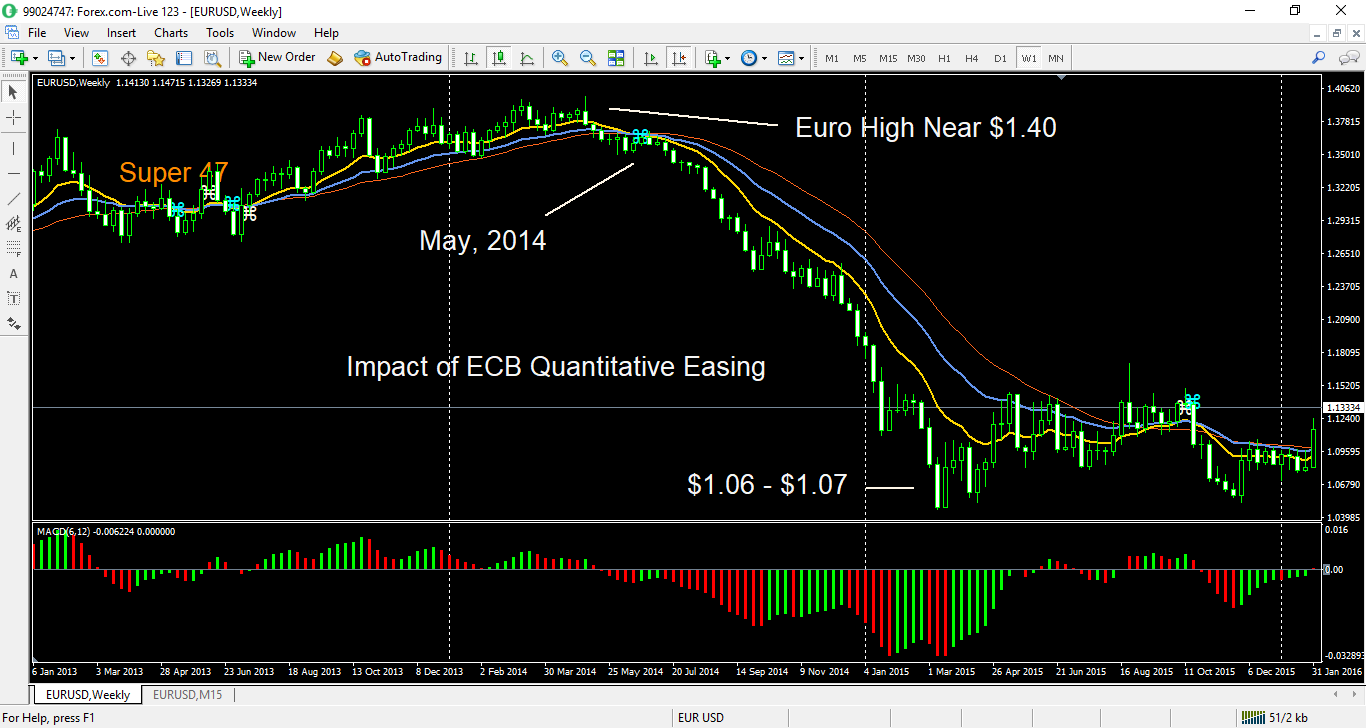

At the same time, economic growth had stalled in Europe. In addition to an overall weak business environment, Greece was headed to bankruptcy and potential withdrawal from the EU. As a result, in May, 2014, the European Central Bank (ECB) headed in the opposite direction from the Fed and initiated its own version of quantitative easing. This action was seen as a drastic measure by the Forex market and one which would lead to much lower interest rates – even negative rates. As a result, over the next several months the Euro dropped dramatically in relation to the U.S. dollar. Here is a weekly chart of the Euro vs U.S. dollar that shows the decline from a high of $1.40 to around $1.06.

As we investigate strategies for profitably trading Forex, it’s clear that in addition to monitoring chart patterns, we need to always keep one eye focused on “fundamental announcements,” the information released each week by government agencies on important economic measurements. These announcements include employment statistics, energy consumption, retail sales, capital goods purchases, inflation data and purchasing manager indexes – in addition to central bank reaction to all of it.

We will continue to post about economic fundamental announcements and interest rate policy in our blog. For further insights and discussion of these important topics, check out our Amazon Kindle book, “The Amazing Zeelander Forex Trading System.” To get directly to the Amazon listing page just add your email and click on the link below. Or simply fill out the short form below and get your free PDF copy of Chapter 3, “Questions about Currencies.”

Good trading to you FxFortuneHunters! Let’s get some Pips!