In a previous post, we stated that interest rate policy decisions by a country’s central bank are the most important factors in a currency’s valuation. But central banks don’t release information about where they are headed with policy every day – or even every week. So Forex traders are left to guess what might happen next. That’s where fundamental announcements enter the equation. And that’s why these announcements can cause price gyrations that ripple through all the currency pairs.

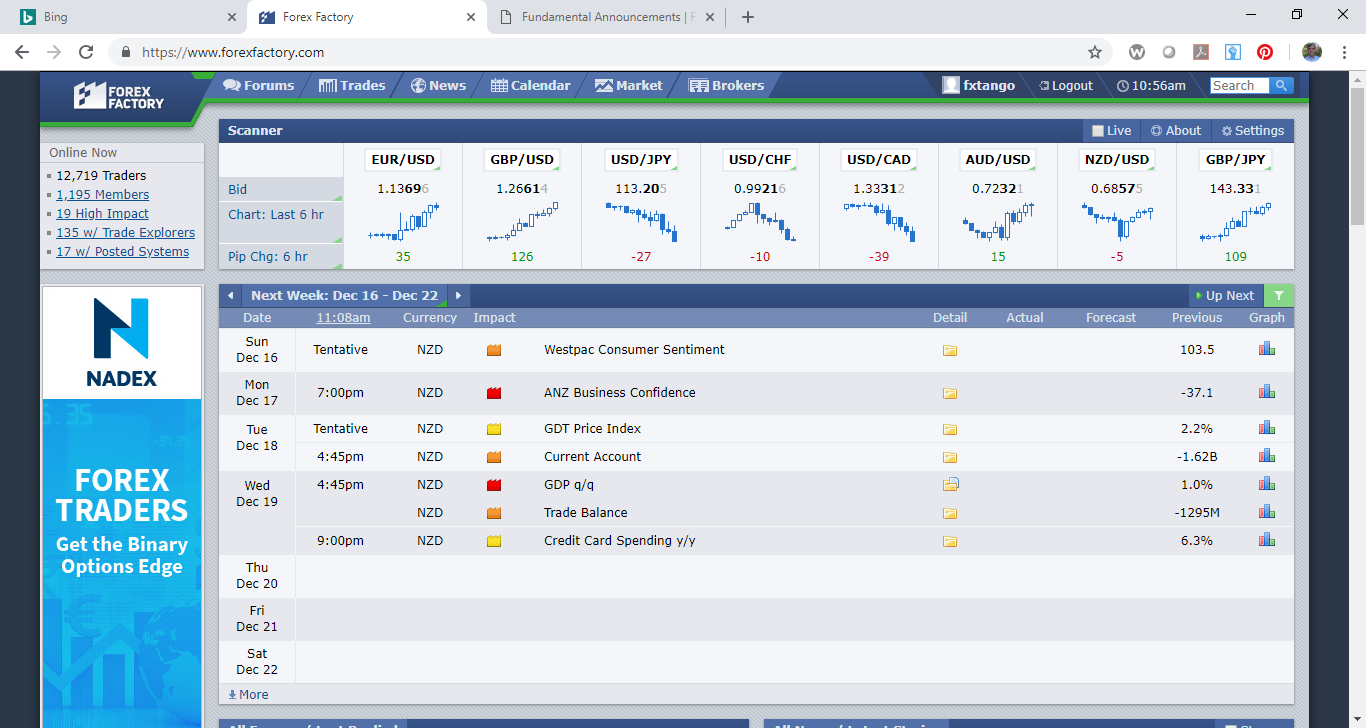

Fundamental announcements, including employment figures, inflation estimates and other indicators of economic activity are released on a calendar schedule by various government agencies and industry associations – worldwide. Information about release dates can be found in various places on line, but one of the major sources is at Forexfactory.com. We have said that keeping an eye on announcement activity in order to protect yourself from a surprise wild swing in price action needs to be a critical part of every trader’s daily check list. So opening the Forex Factory calendar each day before you enter the market is an easy way to build some safety into your trading routine. Most readers understand about using the calendar, but for newcomers, this is a good time to go to the site and find it now.

Once the calendar is open, please note that in the upper left hand corner you can scroll back to see previous announcements. This is helpful if you want to observe the price action of an earlier jobs announcement, for example, in order to estimate what might happen next time that announcement occurs. Likewise, you can sort and filter by country (with the icon in the green box at the top right of the calendar) in order to zoom in on traders’ reactions to various announcements or public comments from bank governors about central bank policy. It doesn’t take a genius to know that when the Federal Reserve announces interest rate actions or releases minutes of previous meetings is a critical time to be on guard for violent price action. When the European Central Bank hints at tightening or loosening in its Director’s press conferences is another time to be on high alert. In addition, there are more subtle news releases to keep track of, as well.

A fascinating example of this can be found with the New Zealand dollar. Check out the calendar section below.

This screenshot is an example of using the filter to see only New Zealand events for the coming week. Of course, the Gross Domestic Product (GDP) announcement upcoming on Wed 19 December will be important, and Forex Factory notes that with a red box. But another piece of information that also typically yields a market price reaction is the GDT Price Index tentatively scheduled for 18 December. Although this is coded yellow, as less important, the New Zealand economy is heavily weighted toward agriculture and especially dairy products. The GDT Price Index shows the result of the most recent dairy products auction. It indicates whether milk and cheese prices are moving up or down. Interestingly, this can have a big impact on the value of the Kiwi especially when other major Asian region issues are on the back burner. If you click on the detail box of this announcement you can see more information about the release.

Because of its volatility, we like to trade the New Zealand Dollar (NZD), especially against the Australian dollar and the Great British Pound. You must be nimble for these pairs! So be careful. But just to see the outcome of one or two of the dairy auction announcements, test your skill, go back through previous auction dates and compare them to the chart dates for NZD in your Metatrader charts. Note the volatility around the announcement release with the Australian dollar on 12/4/2018 in the sample price chart below.

As we have seen in another post about the EUR and USD, when there is divergence in two currencies’ policy initiatives, there can be extreme price movements. As the NZD is impacted by dairy prices, the Australian economy is very much tied to China as its major trading partner. Suffice to say if things aren’t going well in China and dairy is improving for New Zealand, the AUD.NZD currency pair can quickly develop a major trend — or volatile price swings.

FxFortuneHunters. Remember… Disciplined trading requires that you consider the potential for fundamental announcements. Keep track of them. And now, let’s get some Pips!